Can You Fund Your Retirement?

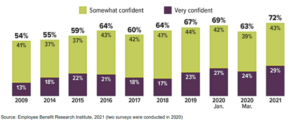

July 2021 See disclaimer on final page In January 2021, more than seven out of 10 workers were very or somewhat confident that they would have enough money to live comfortably throughout their retirement years. This was the highest confidence level since 2000 and a significant rebound from levels in March 2020 after the pandemic began. Overall, retirement confidence has trended upward since the Great Recession.

Don’t Let Debt Derail Your Retirement

Debt poses a growing threat to the financial security of many Americans — and not just college graduates with exorbitant student loans. Recent studies by the Center for Retirement Research at Boston College (CRR) and the Employee Benefit Research Institute (EBRI) reveal an alarming trend: The percentage of older Americans with debt is at its highest level in almost 30 years, and the amount and types of debt are on the rise.

Sources: Center for Retirement Research at Boston College, 2020; Employee Benefit Research Institute, 2020

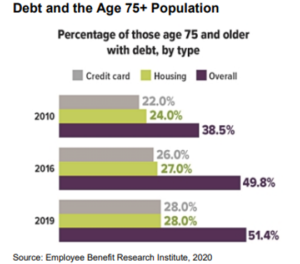

Debt Profile of Older Americans

In the 20-year period from 1998 to 2019, debt increased steadily for families with household heads age 55 and older; in recent years, however, the increase has largely been driven by families with household heads age 75 and older. From 2010 to 2019, the percentage of this older group who carried debt rose from 38.5% to 51.4%, the highest level since 1992. By contrast, the percentage of younger age groups carrying debt either rose slightly or held steady during that period.

Mortgages comprise the largest proportion of debt carried by older Americans, representing 80% of the total burden. According to EBRI, the median housing debt held by those age 75 and older jumped from $61,000 in 2010 to $82,000 in 2019. The CRR study reported that baby boomers tend to have bigger debt loads than older generations, largely because of pricey home purchases financed by small down payments.

Consequently, economic factors that affect the housing market — such as changes in interest rates, home prices, and tax changes related to mortgages — may have a significant impact on the financial situations of both current and future retirees. Credit-card debt is the largest form of non-housing debt among older Americans. In 2019, the incidence of those age 75 and older reporting credit-card debt reached 28%, its highest level ever. The median amount owed rose from $2,100 in 2010 to $2,700 in 2019.

Medical debt is also a problem and often the result of an unexpected emergency. In the CRR study, 21% of baby boomers reported having medical debt, with a median balance

of $1,200. Among those coping with a chronic illness, one in six said they carry debt due to the high cost of prescription medications.

Finally and perhaps most surprisingly, student loan obligations are the fastest-growing kind of debt held by older adults. Sadly, it appears that older folks are generally not borrowing to pursue their own academic or professional enrichment, but instead to help children and grandchildren pay for college.

How Debt Might Affect Retirement

Both the CRR and EBRI studies warn that increasing debt levels may be unsustainable for current and future retirees. For example, because the stress endured by those who carry high debt loads often results in negative health consequences, which then result in even more financial need, the effect can be a perpetual downward spiral. Another potential impact is that individuals may find themselves postponing retirement simply to stay current on their debt payments. Yet another is the risk that both workers and retirees may be forced to tap their retirement savings accounts earlier than anticipated to cope with a debt-related crisis.

If you are retired or nearing retirement, one step you can take is to evaluate your debt-to-income and debt-to-assets ratios, with the goal of reducing them over time. If you still have many years ahead of you until retirement, consider making debt reduction as high a priority as building your retirement nest egg.

Life Insurance Beneficiary Mistakes to Avoid

Life insurance has long been recognized as a useful way to provide for your heirs and loved ones when you die. Naming your policy’s beneficiaries should be a relatively simple task. However, there are several situations that can easily lead to unintended and adverse consequences you may want to avoid.

Not Naming a Beneficiary

The most obvious mistake you can make is failing to name a beneficiary of your life insurance policy. But simply naming your spouse or child as beneficiary may not suffice. It is conceivable that you and your spouse could die together, or that your named beneficiary may die before you do. If the beneficiaries you designated are not living at your death, the insurance company may pay the death proceeds to your estate, which can lead to other potential problems.

Death Benefit Paid to Your Estate

If your life insurance benefit is paid to your estate, several undesired issues may arise. First, the insurance proceeds likely become subject to probate, which may delay the payment to your heirs. Second, life insurance that is part of your probate estate is subject to claims of your probate creditors. Not only might your heirs have to wait to receive their share of the insurance, but your creditors may satisfy their claims out of those proceeds first.

Naming primary, secondary, and final beneficiaries may avoid having the proceeds ultimately paid to your estate. If the primary beneficiary dies before you do, then the secondary or alternate beneficiaries receive the proceeds. And if the secondary beneficiaries are unavailable to receive the death benefit, you can name a final beneficiary, such as a charity, to receive the insurance proceeds.

Naming a Minor Child as Beneficiary

Unintended consequences may arise if your named beneficiary is a minor. Insurance companies will rarely pay life insurance proceeds directly to a minor. Typically, the court appoints a guardian — a potentially costly and time-consuming process — to handle the proceeds until the minor beneficiary reaches the age of majority according to state law.

If you want the life insurance proceeds to be paid for the benefit of a minor, consider creating a trust that names the minor as beneficiary. Then the trust manages and pays the proceeds from the insurance according to the terms and conditions you set out in the trust document. Consult with an estate attorney to decide on the course that works best for your situation.

It’s not uncommon to name multiple beneficiaries to share in the life insurance proceeds. But what happens if one of the beneficiaries dies before you do? Do you want the share of the deceased beneficiary to be added to the shares of the surviving beneficiaries, or do you want the share to pass to the deceased beneficiary’s children? That’s the difference between per stripes and per capita.

Per Capita or Per Stripes Designations

You don’t have to use the legal terms in directing what is to happen if a beneficiary dies before you do, but it’s important to indicate on the insurance beneficiary designation form how you want the share to pass if a beneficiary predeceases you. Per stripes (by branch) means the share of a deceased beneficiary passes to the next generation in line. Per capita (by head) provides that the share of the deceased beneficiary is added to the shares of the surviving beneficiaries so that each receives an equal share.

Disqualifying a Beneficiary from Government Assistance

A beneficiary you name to receive your life insurance may be receiving or is eligible to receive government assistance due to a disability or other special circumstance. Eligibility for government benefits is often tied to the financial circumstances of the recipient. The payment of insurance proceeds may be a financial windfall that disqualifies your beneficiary from eligibility for government benefits, or the proceeds may have to be paid to the government entity as reimbursement for benefits paid. Again, an estate attorney can help you address this issue.

Review All Your Beneficiary Designations

In addition to life insurance, you may have other accounts that name a beneficiary. Be sure to periodically review the beneficiary designations on each of these accounts to ensure that they are in line with your intended wishes. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

Is It Time to Cut Cable?

An explosion in the number and variety of streaming services, coupled with more time spent at home in the last year, might have you wondering whether it’s time to cut the cord on cable. After all, cable isn’t getting any cheaper. At the beginning of 2021, many large cable and satellite television companies announced higher prices and reinstated data caps, which were temporarily suspended in 2020 by the Federal Communications Commission.[1] But is it really worth it to ditch cable in favor of streaming services? Consider the following before you make the switch.

Determine how much of your cable subscription you actually use.

Are you regularly watching all the channels you pay for, or do you watch only a few of them? Are the channels you watch worth what you pay each month? The answers to these questions may help you decide whether the cost of your cable subscription is worth it.

Know your viewing preferences.

Streaming services often delay the release of new TV show episodes, which can be frustrating for dedicated viewers. And sports fans might be disappointed to learn that it’s difficult to access live sports coverage through most streaming services. Comprehensive sports packages are offered by some services, but usually at a higher cost, and you may need to bundle a few services together depending on whether you want local, national, and/or international coverage. Plus, delays in live programming can make it tough to tune in to your favorite teams.

Compare streaming services.

A dizzying array of streaming services are available. Narrow down your choices by making a list of the ones that most appeal to you. If possible, sign up for free trials to find out what is (and what isn’t) a good fit. And investigate the terms and conditions of any service that you decide to try — look for termination fees and how much any add-ons might cost.

Consider the benefits and limitations.

In addition to being less expensive than cable, most streaming services are user-friendly. And as long as you have an Internet connection, streaming services allow you to view your favorite shows on the go on your cell phone or tablet. But not all streaming services offer extras such as digital video recording (DVR) or live television pausing, which are cable features you might miss. You may also have to subscribe to multiple streaming services to access all your preferred programs, which could mean you won’t save much (or any) money in the long run.

Factor in the cost of extra equipment.

You may need to invest in special streaming devices to access the programs you want. You might also consider the cost of high-speed Internet — you won’t be able to successfully stream without a relatively fast Internet connection.

[1] Consumer Reports, December 21, 2020Round Rock Advisors LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website www.RoundRockAdvisors.com for important disclosures. This newsletter is intended to provide general information. It is not intended to offer or deliver tax, legal, or specific investment advice in any way. For tax or legal advice, please consult a qualified tax professional or legal counsel. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Cited content on in this newsletter is based on generally-available information and is believed to be reliable. The Advisor does not guarantee the performance of any investment or the accuracy of the information contained in this newsletter. For information on the Advisor’s services and fees, please refer to the Round Rock’s Form ADV Part 2. The Advisor will provide all prospective clients with a copy of Round Rock’s Form ADV2A and applicable Form ADV 2Bs. Please contact us to request a free copy via .pdf or hardcopy.