Different Inflation Measures, Different Purposes

The inflation measure most often mentioned in the media is the Consumer Price Index for All Urban Consumers (CPI-U), which tracks the average change in prices paid by consumers over time for a fixed basket of goods and services. In setting economic policy, however, the Federal Reserve Open Market Committee focuses on a different measure of inflation — the Personal Consumption Expenditures (PCE) Price Index, which is based on a broader range of expenditures and reflects changes in consumer choices. More specifically, the Fed focuses on “core PCE,” which strips out volatile food and energy categories that are less likely to respond to monetary policy. Over the last 10 years, core PCE prices have generally run below the Fed’s 2% inflation target.

Sequence Risk: Preparing to Retire in a Down Market

“You can’t time the market” is an old maxim, but you also might say, “You can’t always time retirement.”

Market losses on the front end of retirement could have an outsize effect on the income you receive from your portfolio by reducing the assets available to pursue growth when the market recovers. The risk of experiencing poor investment performance at the wrong time is called sequence risk or sequence-of-returns risk.

Dividing Your Portfolio

One strategy that may help address sequence risk is to divide your retirement portfolio into three different “baskets” that could provide current income, regardless of market conditions, and growth potential to fund future income. Although this method differs from the well-known “4% rule,” an annual income target around 4% of your original portfolio value might be a reasonable starting point, with adjustments based on changing needs, inflation, and market returns.

Basket #1: Short term (1 to 3 years of income).

This basket holds stable liquid assets such as cash and cash alternatives that could provide income for one to three years. Having sufficient cash reserves might enable you to avoid selling growth-oriented investments during a down market.

Basket #2: Mid term (5 or more years of income).

This basket — equivalent to five or more years of your needed income — holds mostly fixed-income securities, such as intermediate- and longer-term bonds, that have moderate growth potential with low or moderate volatility. It might also include some lower-risk, income-producing equities.

The income from this basket can flow directly into Basket #1 to keep it replenished as the cash is used for living expenses. If necessary during a down market, some of the securities in this basket could be sold to replenish Basket #1.

Basket #3: Long term (future income).

This basket is the growth engine of the portfolio and holds stocks and other investments that are typically more volatile but have higher long-term growth potential. Investment gains from Basket #3 can replenish both of the other baskets. In a typical 60/40 asset allocation, you might put 60% of your portfolio in this basket and 40% spread between the other two baskets. Your actual percentages will depend on your risk tolerance, time frame, and personal situation.

With the basket strategy, it’s important to start shifting assets before you retire, at least by establishing a cash cushion in Basket #1. There is no guarantee that putting your nest egg in three baskets will be more successful in the long term than other methods of drawing down your retirement savings. But it may help you to better visualize your portfolio structure and feel more confident about your ability to fund retirement expenses during a volatile market.

All investments are subject to market fluctuation, risk, and loss of principal. Asset allocation does not guarantee a profit or protect against investment loss. The principal value of cash alternatives may be subject to market fluctuations, liquidity issues, and credit risk. Bonds redeemed prior to maturity may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve higher risk.

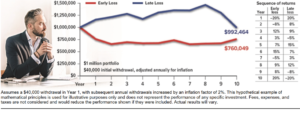

Early Losses

A significant market downturn during the first two years of retirement could make a big difference in the size of a portfolio after 10 years, compared with having the same downturn at the end of the 10-year period. Both scenarios are based on the same returns, but in reverse order.

Watch Out for These Financial Pitfalls in the New Year

As people move through different stages of life, there are new financial opportunities and potential pitfalls around every corner. Here are common money mistakes to watch out for at every age.

Your 20s & 30s

Being financially illiterate. By learning as much as you can about saving, budgeting, and investing now, you could benefit from it for the rest of your life.

Not saving regularly. Save a portion of every paycheck and then spend what’s left over — not the other way around. You can earmark savings for short-, medium-, and long-term goals. A variety of mobile apps can help you track your savings progress.

Living beyond your means. This is the corollary of not saving. If you can’t manage to stash away some savings each month and pay for most of your expenses out-of-pocket, then you need to rein in your lifestyle. Start by cutting your discretionary expenses, and then look at ways to reduce your fixed costs.

Spending too much on housing. Think twice about buying a house or condo that will stretch your budget to the max, even if a lender says you can afford it. Consider building in space for a possible dip in household income that could result from a job change or a leave from the workforce to care for children.

Overlooking the cost of subscriptions and memberships. Keep on top of services you are paying for (e.g., online streaming, cable, the gym, your smartphone bill, food delivery) and assess whether they still make sense on an annual basis.

Not saving for retirement. Perhaps saving for retirement wasn’t on your radar in your 20s, but you shouldn’t put it off in your 30s. Start now and you still have 30 years or more to save. Wait much longer and it can be hard to catch up. Start with whatever amount you can afford and add to it as you’re able.

Not protecting yourself with insurance. Consider what would happen if you were unable to work and earn a paycheck. Life insurance and disability income insurance can help protect you and your family.

Your 40s

Not keeping your job skills fresh. Your job is your lifeline to income, employee benefits, and financial security. Look for opportunities to keep your skills up-to-date and stay abreast of new workplace developments and job search technologies.

Spending to keep up with others. Avoid spending money you don’t have trying to keep up with your friends, family, neighbors, or colleagues. The only financial life you need to think about is your own.

Funding college over retirement. Don’t prioritize saving for college over saving for retirement. If you have limited funds, consider setting aside a portion for college while earmarking the majority for retirement. Closer to college time, have a frank discussion with your child about college options and look for creative ways to help reduce college costs.

Using your home equity like a bank. The goal is to pay off your mortgage by the time you retire or close to it — a milestone that will be much harder to achieve if you keep moving the goal posts. Ignoring your health. By taking steps now to improve your fitness level, diet, and overall health, not only will you feel better today but you may reduce your health-care costs in the future.

Your 50s & 60s

Co-signing loans for adult children. Co-signing means you’re 100% on the hook if your child can’t pay — a less-than-ideal situation as you approach retirement.

Raiding your retirement funds before retirement. It goes without saying that dipping into your retirement funds will reduce your nest egg, a significant tradeoff for purchases that aren’t true emergencies.

Not knowing your sources of retirement income. As you near retirement, you should know how much money you (and your partner, if applicable) can expect from three sources: your personal retirement accounts (e.g., 401(k) plans and IRAs); pension income from an employer; and Social Security at age 62, full retirement age, and age 70.

Not having a will or advance medical directive. No one likes to think about death or catastrophic injury, but these documents can help your loved ones immensely if something unexpected should happen to you.