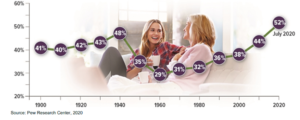

Majority of Young Adults Living at Home

In 2020, a record number of 18- to 29-year-olds lived at home with their parents. In July, 52% of young adults were living at home, surpassing the previous high of 48% recorded in 1940 at the end of the Great Depression. This record return to the family home has been driven by the coronavirus pandemic and exacerbated by the overall economic downturn, record-low housing inventory along with a shortage of affordable entry-level homes, and high levels of student debt. The number of young adults living with their parents grew across the board for all demographic groups and regions of the country.

Source: Pew Research Center, 2020

Key Retirement and Tax Numbers for 2021

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2021.

Estate, Gift, and Generation-Skipping Transfer Tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2021 is $15,000, the same as in 2020.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2021 is $11,700,000, up from $11,580,000 in 2020.

Standard Deduction

A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2021, the standard deduction is:

- $12,550 (up from $12,400 in 2020) for single filers or married individuals filing separate returns

- $25,100 (up from $24,800 in 2020) for married individuals filing joint returns

- $18,800 (up from $18,650 in 2020) for heads of households

The additional standard deduction amount for the blind or aged (age 65 or older) in 2021 is:

- $1,700 (up from $1,650 in 2020) for single filers and heads of households

- $1,350 (up from $1,300 in 2020) for all other filing statuses

Special rules apply if you can be claimed as a dependent by another taxpayer.

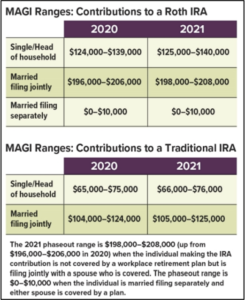

IRAs

The combined annual limit on contributions to traditional and Roth IRAs is $6,000 in 2021 (the same as in 2020), with individuals age 50 and older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges. For individuals who are covered by a workplace retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges. (The limit on nondeductible contributions to a traditional IRA is not subject to phase-out based on MAGI.)

Employer Retirement Plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $19,500 in compensation in 2021 (the same as in 2020); employees age 50 and older can defer up to an additional $6,500 in 2021 (the same as in 2020).

- Employees participating in a SIMPLE retirement plan can defer up to $13,500 in 2021 (the same as in 2020), and employees age 50 and older can defer up to an additional $3,000 in 2021 (the same as in 2020).

Kiddie Tax: Child’s Unearned Income

Under the kiddie tax, a child’s unearned income above $2,200 in 2021 (the same as in 2020) is taxed using the parents’ tax rates.

Are Value Stocks Poised for a Comeback?

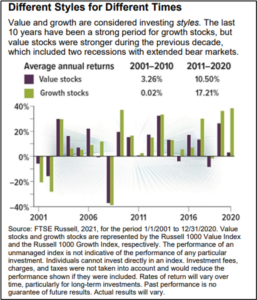

Growth stocks have dominated the market for the last decade, led by tech giants and other fast-growing companies. While it’s possible this trend may continue, some analysts think that value stocks may have strong appeal during the economic recovery.[1]

No one can predict the market, of course. And past results are never a guarantee of future performance. But it may be helpful to consider these two types of stocks and the place they hold in your portfolio.

Value stocks are associated with companies that appear to be undervalued by the market or are in an industry that is currently out of favor. These stocks may be priced lower than might be expected in relation to their earnings, assets, or growth potential. In an expensive market, value stocks can offer bargains.

Established companies are more likely than younger companies to be considered value stocks. Older businesses may be more conservative with spending and emphasize paying dividends over reinvesting profits. The potential for solid dividend returns regardless of market direction is one reason why value stocks can be appealing, especially in the current low-interest environment. An investor who purchases a value stock typically expects the broader market to eventually recognize the company’s full potential, which might push the stock price upward. One risk is that a stock may be undervalued for reasons that cannot be easily remedied, such as legal difficulties, poor management, or tough competition.

1 The Wall Street Journal, September 30, 2020

Growth stocks are associated with companies that appear to have above-average growth potential. These companies may be on the verge of a market breakthrough or acquisition, or they might occupy a strong position in a growing industry. The dominance of large technology stocks over the last few years is one example of this.

Growth companies may be more aggressive with spending and place more emphasis on reinvesting profits than paying dividends (although many larger growth companies do offer dividends). Investors generally hope to benefit from future capital appreciation. Growth stocks may be priced higher in relation to current earnings or assets, so investors are essentially paying a premium for growth potential. This is one reason why growth stocks are typically considered to carry higher risk than value stocks.

Diversification and Weighting

Value and growth stocks tend to perform differently under different market conditions (see chart). For diversification, it may be wise to hold both value and growth stocks in your portfolio, but this can be accomplished by investing in broad index funds, which generally include a mix of value and growth stocks. These are considered blended funds.

Typically, investors who follow a value or growth strategy weight their portfolios to one side or the other through funds or individual stocks. If you use a mutual fund or exchange traded fund (ETF) to emphasize value or growth in your equity portfolio, it’s important to understand the fund’s objectives and structure, including the index that the fund uses as a benchmark.

Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against loss. The return and principal value of stocks, mutual funds, and ETFs fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. The amount of a company’s dividend can fluctuate with earnings, which are influenced by economic, market, and political events. Dividends are typically not guaranteed and could be changed or eliminated.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Tips to Help Control Your Finances During the Pandemic

The coronavirus pandemic has strained the finances of many U.S. households. In an August 2020 survey, 25% of adults said someone in their household had experienced the loss of a job due to the outbreak. Even among those who did not lose a job, 32% said someone in their household has had to reduce hours or take a pay cut due to the economic fallout from the pandemic.[1] During these times of financial turmoil and stress, it’s more important than ever to take control of your financial situation. Here are some tips to get started.

- Make sure your budget is on track. A solid budget is the centerpiece of any good financial plan because it will give you a clear picture of how much money is coming in and how much is going out. Hopefully, you’ve been able to stay the course during the pandemic and your budget is still on track. If you’ve experienced a loss or reduction in income, you may have to cut back on discretionary spending or look for ways to lower your fixed costs. Budgeting websites and smartphone apps can help you analyze your saving and spending patterns.

- Maintain healthy spending habits. During the height of the pandemic, your spending habits may have changed dramatically. With restaurants closed, vacations postponed, and events canceled, many Americans found themselves spending less. If you were fortunate enough to save money during the pandemic, keep up the good work. If you spent more than you would have liked (e.g., takeout, online shopping), try to cut back and save what you can. Even small amounts can add up over time.

- Check your emergency fund. If the pandemic has taught us anything financially, it is the importance of having an emergency fund. If you’ve had to dip into your cash reserve at some point over the past year to cover expenses, you’ll want to work on building it back up. Ideally, you should have at least three to six months of living expenses in your cash reserve. A good way to accumulate emergency funds is to earmark a percentage of your paycheck each pay period. When you reach your goal, you may still want to keep adding money — the more you can save, the better off you could be in the long run.

- Deal with your debt. It is always important to stay on top of your debt situation and pay down debt from student loans, a mortgage, and/or credit cards as quickly as you can. If the financial impact of the pandemic has made it difficult to manage your debt, contact your lenders to see if they offer COVID-related financial assistance. Many may be willing to work with you by waiving interest and certain fees or allowing you to delay, adjust, or skip some payments.

Round Rock Advisors LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Please visit our website www.RoundRockAdvisors.com for important disclosures. This newsletter is intended to provide general information. It is not intended to offer or deliver tax, legal, or specific investment advice in any way. For tax or legal advice, please consult a qualified tax professional or legal counsel. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Cited content on in this newsletter is based on generally-available information and is believed to be reliable. The Advisor does not guarantee the performance of any investment or the accuracy of the information contained in this newsletter. For information on the Advisor’s services and fees, please refer to the Round Rock’s Form ADV Part 2. The Advisor will provide all prospective clients with a copy of Round Rock’s Form ADV2A and applicable Form ADV 2Bs. Please

[1] Pew Research Center, 2020contact us to request a free copy via .pdf or hardcopy.